The privatization of public companies is among the main causes of the global rise in social inequality, according to a study by the international organization Oxfam. The document was released on Monday (15) and indicates that the sale of state-owned companies makes entrepreneurs richer. They profit by providing increasingly expensive services to the poor population.

For years, Oxfam has been working to gather data on the growing social gap between rich and poor around the world. The organization releases an annual report on the topic at the beginning of the World Economic Forum in Davos, Switzerland, where political and business leaders from around the world meet to discuss this and other issues.

This year, the Oxfam report was entitled "Inequality S.A." and focuses on explaining how big companies are among those responsible for the intense and constant rise of inequality in the world.

According to Oxfam, the wealth of the top five richest people in the world has doubled since 2020. At the same time, 60% of the global population – about 5 billion people – became poorer. The document also states that it occurred due to privatization.

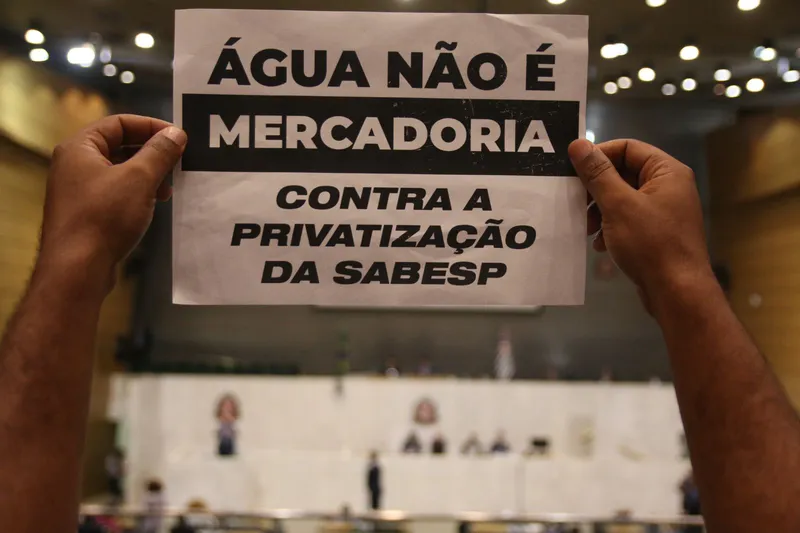

In Brazil, there are politicians such as the governor of São Paulo, Tarcísio de Freitas (Republicans Party) and former president Jair Bolsonaro (Liberal Party) who still defend this type of sale of public assets, allying themselves with the interests of large companies interested in expanding their businesses. For Oxfam, the result of these actions is a greater concentration of income.

"One important - though underestimated - way in which the power of big business fosters inequality is the privatization of public services. Around the world, this power is relentlessly squeezing the public sector, commodifying and often segregating access to vital services like education, water and health, while making huge taxpayer-funded profits and destroying governments' ability to provide the kind of universal, high-quality public services that could transform lives and reduce inequality," reads the report.

"Privatization [of state-owned companies] can work well for the rich, including economic and political elites, who can benefit financially, as well as for those who have sufficient resources to pay for expensive private services. However, a robust body of evidence shows that, in many cases, privatization leads to exclusion, impoverishment and other harmful consequences," he adds.

"Modern privatization"

Oxfam highlights that there is a huge interest in privatization because "they are worth trillions of dollars and mean huge opportunities for generating profits". Institutions like the World Bank – which, in theory, works to reduce poverty and inequality – continue to support this type of business, which today takes place in various forms, such as the "deliberate integration of the business sector into public policies and programs, outsourcing and public-private partnerships [known in Portuguese as PPP]," it lists.

"Many contemporary [privatization] systems, such as PPPs and outsourcing, can be highly costly for the state and require taxpayers to guarantee private sector profits. Fiscal risks of PPPs are particularly high, which has earned them the nickname 'budgetary time bombs'. The fact that these systems often represent a heavy burden on public coffers and, generally, cost more than public services, calls into question the arguments that privatization is necessary because the public sector lacks sufficient resources," writes Oxfam about new forms of privatization.

Mauricio Weiss, an economist and professor at the Federal University of Rio Grande do Sul (UFRGS), adds that the financial situation of the states remains the biggest argument in favor of privatization. According to him, even in Brazil, the business sector pressures governments to cut spending and control the public budget. This makes it impossible for state-owned companies to function and provide quality services. Therefore, the only thing left for the state to do is privatize.

"What does the financial market say? That the state has to cut spending. If spending is cut, the government reduces investment, including in state-owned companies. They [the companies] stop being efficient, then become an argument for privatization," Weiss explains. "The private sector demonizes state-owned companies because they want privatization at a low price on the market."

According to Weiss, this austerity idea has guided Bolsonaro's privatization processes. Companies like Eletrobras were sold for questionable amounts. Businesspeople took a percentage of essential sectors with few competitors – in this case, the electricity sector – laid off workers and increased the board's earnings.

Eletrobras, for instance, launched a voluntary redundancy plan (PDV, in Portuguese) after privatization to lay off over 2,000 workers. At the same time, the company increased the salaries of its directors by 3,500 percent.

Tax inequality

Jefferson Nascimento, the coordinator of Social and Economic Justice at Oxfam Brazil, says that strengthening the public budget is crucial to preventing privatization and reducing inequality. This basically happens by collecting more taxes from the rich in order to offer better services to the poor.

"There is broad support to provide universal public services - and they come at a cost. They are paid for by taxes," he said. "Taxes need to be fair to finance these services."

However, Brazil's tax system contributes to injustices, says Nascimento. The government grants tax breaks to companies and on certain expenses that only benefit the wealthy population.

He points out, for instance, that all medical costs can be deducted from income tax. However, only the wealthy have this kind of expense, since a large part of the population uses the National Public Health System (SUS, in Portuguese). "Around 400,000 people deducted BRL 26 billion from their income tax in 2022 alone. That's 23% of everything that was deducted from medical expenses in the year, according to data from Brazil's Revenue Service."

Nascimento says the government of President Luiz Inácio Lula da Silva (Workers' Party) has signaled an effort to change income taxation in the country. For him, however, it's not as clear as the effort made to reform taxes on consumption, which was approved last year without a significant effect on inequality.

At the same time, the government set a zero deficit for public accounts from 2024 and put the New Fiscal Framework (Naf, in Portuguese) into effect. The new rule limits public spending having revenue growth as the basis to calculate it. This could weaken the state even more if revenues don't grow and could ultimately encourage new privatization processes.